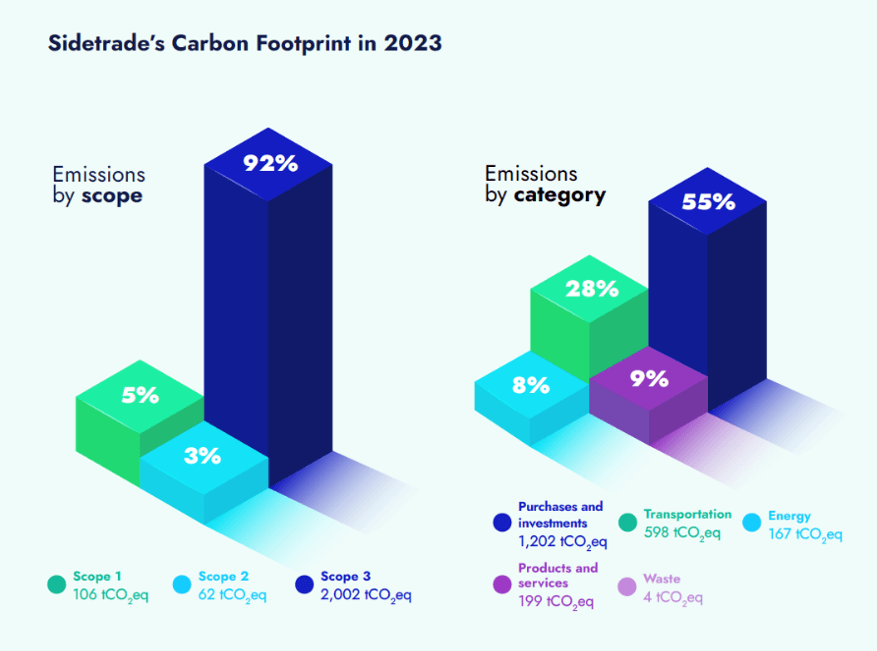

Utilizing the certified Bilan Carbone® methodology, Sidetrade analyzed the emissions across its entire operational scope, encompassing France, the UK, Ireland, Canada, and the USA. With a strategy to manage carbon emissions across scopes 1, 2, and 3, Sidetrade has focused on responsible purchasing, prudent use of digital technology, sustainable internal practices, and eco-friendly mobility solutions.

With a carbon footprint of 2,170 tons of CO2 equivalent for 2023, Sidetrade reduced its emissions by 5% from 2022. This achievement is particularly notable given the company’s simultaneous 20% revenue growth at constant exchange rates. The positive contrast highlights the effectiveness of Sidetrade’s energy-saving measures, demonstrating its dedication to sustainability alongside financial success.

Sidetrade’s carbon intensity performance not only aligns with the industry standard but also sets a benchmark for excellence, as highlighted in a 2023 comparative study by Eiffel Investment Group based on Ethifinance ESG Ratings data, said Emilie da Silva, Managing Director at Eiffel.This achievement underscores their commitment to environmental responsibility while excelling in a competitive market, proving that sustainability and success can thrive together.

Sidetrade made significant strides by optimizing its IT infrastructure management and reducing server energy consumption, cutting scope 3 emissions to 2,002 tons of CO2 equivalent — a 7% decrease from 2022.

By reducing our carbon footprint by 5% while simultaneously achieving a 20% revenue growth, we’ve demonstrated that environmental and financial performance can go hand in hand. We take an impact-based approach to the development of our AI solutions, designed to minimize our impact on the environment whilst also maximizing value delivered for our customers, said Philippe Gangneux, CFO and CSR Ambassador of Sidetrade. Companies with a commitment to CSR are not only better positioned to meet the ecological expectations of stakeholders but also tend to outperform those that do not prioritize sustainability.

Recognizing that the journey towards a sustainable future is ongoing, Sidetrade remains steadfast in its commitment to controlling emissions, both now and in the future. As the company looks ahead, it continues to focus on scope 3 emissions, aligning its efforts with stakeholders‘ ecological expectations and strengthening its dedication to environmental protection.

Allison Barlaz joins Sidetrade with over twenty-five years’ experience in product and marketing roles across software companies, including SaaS vendors. In her new role, Barlaz provides visionary leadership and strategic marketing direction, contributing to Sidetrade’s expansion goals. She joins the executive committee of Sidetrade, expanding its membership to 10.

Allison joins us at milestone moment for Sidetrade as it steers through significant Gen AI transformations said Olivier Novasque, CEO of Sidetrade. Her success building B2B brands coupled with her martech expertise is pivotal in our market reach and new growth initiatives.

Barlaz has a proven track record in demand generation, leveraging new marketing technologies to support business objectives and drive revenue growth. In addition, she has experience in the Order-to-Cash market, having spearheaded BlackLine’s demand generation and digital marketing strategy for more than two years.

Commenting on her new role, Barlaz said: It’s an exciting time for the Order-to-Cash market as the impact of AI technology becomes more evident each day. Sidetrade is well positioned to help clients realize this untapped value, as demonstrated by our three-time positioning as a Leader in the Gartner® Magic QuadrantTM for Invoice-to-Cash Applications. I am excited to contribute to this market leader and help drive its next phase of growth globally.

Barlaz is based in the US and holds degrees from INSEAD Business School, UC Berkeley, and the University of Pennsylvania, underscoring her formidable background and readiness to lead Sidetrade’s marketing endeavors.

Gartner, “Magic Quadrant for Invoice-to-Cash Applications”, Tamara Shipley, Valeria Di Maso and Miles Onafowora, May 6, 2024.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

New management at SHS Viveon AG as Sidetrade takes majority control

Sidetrade AG, a wholly owned subsidiary of Sidetrade group, has now secured 1,977,439 shares, representing 79.39% of SHS Viveon AG’s outstanding share capital, thereby becoming the majority shareholder.

On June 4, 2024, Olivier Novasque, CEO of Sidetrade, was appointed as the new CEO of SHS Viveon AG: I’m excited to lead the SHS Viveon team of talented employees who bring with them impressive expertise and skills in risk management. Together, we will innovate, reach new heights, and continue to serve our valued customers in Germany and beyond with passion.

In conjunction with this appointment, the Supervisory Board of SHS Viveon AG implemented further significant changes on June 10, 2024. Philippe Gangneux, CFO of Sidetrade, was appointed the new Chairman of the SHS Viveon AG Supervisory Board. Mark Sheldon, CTO of Sidetrade, was named as a new Board member, joining Heinz Resch, who remains as Deputy Chairman.

SHS Viveon AG delisting approved by Munich Stock Exchange

SHS Viveon AG (ISIN: DE000A0XFWK2) has formally applied to delist its shares from the Munich Stock Exchange. The Munich Stock Exchange decided that the listing on the m:access segment will end on June 30, 2024 and on the regulated unofficial market “Freiverkehr” on November 15, 2024. As a result, after November 15, 2024, SHS Viveon shares will no longer be listed on the capital markets.

In accordance with Munich Stock Exchange, Sidetrade has extended its public tender offer to July 29, 2024 at midnight (CEST, Munich, Germany). This extension provides SHS Viveon’s shareholders with ample time to tender their remaining shares. As stated in the May 2, 2024 press release, Sidetrade’s offer price is €3.00 per SHS Viveon share in cash.

SHS Viveon AG delisting time-frame

| May 7, 2024 | Tender offer opens |

| June 12, 2024 | Delisting of SHS Viveon AG proposed to the Munich Stock Exchange |

| June 17, 2024 | End of the initial tender offer period |

| June 24, 2024 | Extension period of the tender offer opens |

| June 30, 2024 | Delisting of SHS Viveon AG from m:access |

| July 29, 2024 | End of the tender offer period at midnight (CEST Munich, Germany) |

| November 15, 2024 | Delisting of SHS Viveon AG from “Freiverkehr” |

The tender offer is not subject to reaching a minimum acceptance threshold.

The tender offer documentation is available on www.sidetrade.com in German (https://www.sidetrade.com/wp-content/uploads/2024/05/public-tender-offer-shs-viveon-de.pdf) and in English (https://www.sidetrade.com/wp-content/uploads/2024/05/public-tender-offer-shs-viveon.pdf).

Copies of the German language binding document may be obtained at uebernahmeangebot@oddo-bhf.com.

Sidetrade is assisted by King & Spalding LLP as legal advisor on the transaction and ODDO BHF SE as financial advisor.

About SHS Viveon AG, a German leader in credit risk & compliance management software applications

Founded in 1991 and headquartered in Munich, Germany, SHS Viveon AG offers applications designed to enable risk, credit, and compliance management teams to automatically identify, assess, and hedge risks in a flexible, digital process. It simplifies access to all relevant data from any system, improves analysis and simulation, and enables better business decisions.

In 2023, SHS Viveon AG reported revenues of €8.8 million. SHS Viveon AG’s customer portfolio currently comprises 80 businesses including Fortune 100 companies.

Olivier Novasque, CEO of Sidetrade commented: Leaders around the world understand that generative AI is the new frontier for driving business transformation and unexpected growth. At Sidetrade, we are at the forefront of this exciting and rapidly evolving field. Our dedication to innovation is reflected in the solutions and the growth opportunities we create for our wemployees, customers and shareholders.

Our ambition is to revolutionize the Order-to-Cash landscape. By leveraging generative AI and the world’s only real time O2C Data Lake, we are going to reshape industry benchmarks, raising the bar to a level never seen before. We are changing the game for finance teams’ operations allowing them to reach unexpected performance. Our AI, AKA Aimie, unlocks new potential by mastering GenAI efficiency. Aimie processes over $6.1 trillion worth of O2C payment experiences to provide the best performance recommendation every second, surpassing the capabilities of static ERP systems, spreadsheets, rule-based O2C software and even, advanced but too generic ChatGPT abilities. Our mission is to empower finance professionals in their daily life by delivering them not only intelligent automation but the highest level of intelligence in their cash conversion performance across their entire Order-to-Cash journey.

Introducing ‘Ask Aimie’ – Sidetrade’s first generative AI feature

Recently, Sidetrade introduced ‘Ask Aimie’ within the Digital Case solution, the first generative AI feature revolutionizing user experience. This new innovation provides users with concise summaries of lengthy emails from their clients and enables them to generate appropriate replies by choosing from four different templates; this functionality, enables to respond promptly and effectively, maintaining the context throughout the communication.

With ‘Ask Aimie’, finance teams benefit from:

- Streamlined efficiency: Reduced time spent on information gathering and email drafting, freeing up resources for higher-value tasks.

- Enhanced communication: Faster and more personalized customer interactions.

- Improved comprehension: An enriched reading experience with real-time contextual information, helping users understand content without the need for external research.

- Instant insights: Immediate access to a wealth of O2C information, setting new benchmarks in AI predictability, accuracy, transparency, explainability, and user customization.

Rob Harvey, Chief Product Officer of Sidetrade commented: It’s been a quarter of a century since search engines like Google democratized access to universal knowledge. However, it was still up to us to interpret results and create relevant, specific, and accurate content from them. Today, generative AI answers users‘ problems on specialized topics, offering invaluable support even in complex environments. But the benefits of generative AI extend far beyond just producing well-written content. Domain expert LLMs we are leveraging can be fine-tuned to deliver responses that not only exhibit human-like reasoning but also demonstrate a deep understanding of finance and its context. This approach builds trust with users and adds value for our customers.

Our AI, Aimie, mimics human-like reasoning by analyzing billions of transactions in seconds and focusing on the complex context of the customer and their environment. This makes her the most advanced O2C Intelligent Agent on the market. She acts as a mirror, reflecting current customer interactions and revealing blind spots and weaknesses through real time, data-driven insights: Aimie is a superb assistant for text recognition and generation. This enables organizations to enhance relevance, better understand context, and optimize customer responses, ultimately improving customer satisfaction. By freeing up finance teams, sales, and customer services to tackle more complex issues, Aimie further enhances customer satisfaction.

Deploying generative AI technology will allow Sidetrade’s customers to streamline their customer interactions, accelerate their understanding, and personalize their responses for a more human touch.

Combining GenAI with worldwide data to set new standards in Order-to-Cash

Sidetrade’s AI Aimie utilizes machine learning (ML) techniques to analyze customer payment behaviors. Since 2015, Sidetrade has built the most advanced and vast dataset in the Order-to-Cash market, and the only one offering real time AI capabilities. Continuously learning from Sidetrade’s extensive Data Lake, Aimie has been able to recommend optimal collection strategy and act by her own on certain actions. Now, Sidetrade has integrated a new range of data science techniques with the development of its own generative architecture which integrates Large Language Models (LLMs) that are being trained on vast amounts of O2C text data to understand and generate complex human language specific to the industry.

These latest technologies enable Aimie to analyze and understand natural language queries, generate relevant answers, and assist users in anticipating future payment behaviors based on emerging trends and current data. Aimie also leverages big data elements to process and analyze large quantities of Data Lake information, elevating its capability to deliver relevant, accurate, contextualized O2C specific insights that no other vendor can provide.

Mark Sheldon, Chief Technology Officer at Sidetrade: With the O2C industry’s most advanced and only real time Data Lake, Sidetrade is uniquely positioned to capitalize on the potential of generative AI because without data, there is no advanced AI. Sidetrade offers unparalleled insights to customers worldwide, empowering finance professionals to benefit from GenAI. This leads to strategic business growth and operational efficiency in ways previously unattainable. Generative AI places humans back at the heart of processes, without sacrificing performance objectives.

Ensuring data privacy and customization with in-house innovation of LLMs

The advantage of running Sidetrade’s own generative architecture with domain expert LLMs, over generic, third-party hosted LLMs, is that Aimie provides insights that are far more tailored and specific to the O2C industry. Unlike GenAI features on the market that offer much more generalist information, Sidetrade’s AI delivers precision and relevance.

Moreover, unlike other SaaS offerings, all of Sidetrade’s infrastructure, LLMs, and data remain within Sidetrade’s private cloud. This ensures that customer data is fully segregated and never mixed in with external models, prioritizing privacy and security.

Sheldon continued: Sidetrade’s approach to generative AI ensures that our technology upholds the highest standards of privacy, sovereignty, and accuracy. Instead of adopting a plug-and-play approach, we have built an entire ecosystem in-house, taking full ownership of the intellectual property. This strategy offers a whole host of benefits to our customers, both now and in the future, including a more bespoke, customized and accurate service. Additionally, it provides the reassurance that their data never leaves our secure cloud environment.

According to Gartner (source: Magic Quadrant Research Methodology | Gartner), “Leaders execute well against their current vision and are well positioned for tomorrow.“

Sidetrade Chief Product Officer, Rob Harvey said:Being named as a Leader by Gartner for the past three years is a remarkable recognition for us. At Sidetrade, we take pride in our commitment to innovation, and we believe this recognition reflects our advancements in artificial intelligence and the value we create for our clients.

At a time when AI tends to be seen as a commodity, the differentiating factor is the quality of the data. The reason is simple: there is no high-performance AI without data. Sidetrade’s AI – nicknamed Aimie – stands out with its exclusive access to the Sidetrade Data Lake, allowing her to mine a vast source of financial and business data. This unique capacity gives Aimie exceptional accuracy in analyzing payment behaviors and predicting the dynamics of cash flow generation. Aimie is continuously enriched with millions of data points, leveraging the latest in machine learning, natural language processing and, more recently, generative AI. The power of our AI, fueled by our Data Lake, demonstrates our advanced expertise in algorithms.

From Sidetrade’s perspective, being recognized as one of the vendors positioned in the Leaders Quadrant in the 2024 Gartner Magic Quadrant acknowledges its AI capabilities, product strategy and customer support.

Sidetrade Chief Executive Officer, Olivier Novasque said:Being named a Leader in the Gartner Magic Quadrant for Invoice-to-Cash Applications for three years in a row means a lot to us, and it’s fantastic to be recognized for both our ability to execute and completeness of vision. It offers credibility and visibility in competitive markets but also trust among large global organizations, demonstrating Sidetrade’s reliability and effectiveness. Additionally, we believe this recognition supports Sidetrade’s expansion efforts, helping to establish a strong foothold and attract new business, in particular in North America.

Download a copy of this 2024 Gartner Magic Quadrant report, here.

Source Gartner, “Magic Quadrant for Invoice-to-Cash Applications”, Tamara Shipley, Valeria Di Maso and Miles Onafowora, May 6, 2024.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

As announced in the May 2, 2024 press release, Sidetrade’s tender offer for SHS Viveon AG has been posted in the Federal Gazette, an official promulgation and announcement organ of the Federal Republic of Germany, today. The price of this friendly offer is €3.00 per SHS Viveon share in cash.

Planned milestones for Sidetrade’s acquisition of SHS Viveon AG

| May 7, 2024 | Tender offer opens |

| May 9, 2024 | Delisting of SHS Viveon AG proposed to the Munich Stock Exchange |

| June 17, 2024 | Tender offer closes |

The tender offer is not subject to reaching a minimum acceptance threshold.

The tender offer documentation is available on www.sidetrade.com in German (https://www.sidetrade.com/wp-content/uploads/2024/05/public-tender-offer-shs-viveon-de.pdf) and in English (https://www.sidetrade.com/wp-content/uploads/2024/05/public-tender-offer-shs-viveon.pdf).

Copies of the German language binding document may be obtained at uebernahmeangebot@oddo-bhf.com.

Sidetrade will support the delisting of SHS Viveon AG’s shares from the open market m:access of the Munich stock exchange. Post delisting, SHS Viveon AG shares will not trade anymore in Germany (either Frankfurt or Munich).

Sidetrade is assisted by King & Spalding LLP as legal advisor on the transaction and ODDO BHF SE as financial advisor.

Following the execution of binding agreements with shareholders of SHS Viveon AG to acquire shares at a price of €3.00 each, as announced in the April 16, 2024 press release, Sidetrade has secured 1,702,407 shares, representing 68.4% of SHS Viveon AG’s outstanding share capital as follows:

- 43.0% of the SHS Viveon shares already acquired.

- 5.7% of the SHS Viveon shares set to be acquired in the coming days.

- 19.7% of the SHS Viveon shares to be acquired at subsequent dates at the latest in July 2024.

Sidetrade plans to open its public tender offer on May 7, 2024, to acquire the remaining shares of SHS Viveon AG at €3.00 per share in cash, representing a 53% premium over the 1-year VWAP (Volume-weighted average price) of SHS Viveon AG (€1.96 per share) as of April 15, 2024.

SHS Viveon AG’s supervisory board signed a business combination agreement with Sidetrade on May 1, 2024, and supports Sidetrade’s take-over plans.

Planned milestones for Sidetrade’s acquisition of SHS Viveon AG

| May 6, 2024 | Tender offer posted in the Federal Gazette |

| May 7, 2024 | Tender offer opens |

| May 9, 2024 | Delisting of SHS Viveon AG proposed to the Munich Stock Exchange |

| June 17, 2024 | Tender offer closes |

The tender offer is not subject to reaching a minimum acceptance threshold.

The tender offer documentation will be available in German and in English on May 6, 2024 on www.sidetrade.com. Copies of the German language binding document may be obtained by email at uebernahmeangebot@oddo-bhf.com.

Certain SHS Viveon AG’s shareholders entered into a binding agreement with Sidetrade to transfer 19.7% of their shares at subsequent dates at the latest in July 2024.

Upon completing these acquisitions, Sidetrade will become the majority shareholder and assume control of SHS Viveon AG. Sidetrade will support the delisting of SHS Viveon AG’s shares from the open market m:access of the Munich stock exchange. Post delisting, SHS Viveon AG shares will not trade anymore in Germany (either Frankfurt or Munich).

Sidetrade is assisted by King & Spalding LLP as legal advisor on the transaction and ODDO BHF SE as financial advisor.

About SHS Viveon AG, a German leader in credit risk & compliance management software applications

Founded in 1991 and headquartered in Munich, Germany, SHS Viveon AG offers applications designed to enable risk, credit, and compliance management teams to automatically identify, assess, and hedge risks in a flexible, digital process. It simplifies access to all relevant data from any system, improves analysis and simulation, and enables better business decisions.

In 2023, SHS Viveon AG reported revenues of €8.8 million. SHS Viveon AG’s customer portfolio currently comprises 80 businesses including Fortune 100 companies.

Sidetrade’s 2023 Annual Report provides a synthesis of its environment, activities, strategy, governance, and looks back over the events that marked the financial year. It establishes the link between financial and non-financial performance.

The document is available on the company’s website here.

Philippe Gangneux, CSR Ambassador and Chief Financial Officer of Sidetrade, commented:

Given the growing interest in our activities and our international development, the publication of an annual report linking financial and non-financial performance was an important challenge. This represents a new initiative in our transparent communication approach, and shedding light on our expansion combining growth and profitability.

Sidetrade today announces that it has entered into binding agreements with shareholders of SHS Viveon AG to acquire more than 50% of all outstanding shares in SHS Viveon AG at a price of €3.00 per share.

The number of shares Sidetrade has the intention to acquire is 1,462,489 shares, representing 58.73% of the outstanding share capital of SHS Viveon AG:

- 43.30% of the SHS Viveon shares would be acquired by Sidetrade in the coming days; and

- 15.43% at subsequent dates in June and July 2024.

The price of €3.00 per share represents a 53% premium over the 1-year VWAP (Volume-weighted average price) of SHS Viveon AG (€1.96 per share) as of April 15, 2024.

Sidetrade is also currently considering acquiring additional SHS Viveon AG shares from existing shareholders at €3.00 per share.

In addition to the aforementioned acquisitions, Sidetrade is considering launching a public tender offer to acquire the remaining shares of SHS Viveon AG also at €3.00 per share.

Upon completion of these acquisitions, Sidetrade would become the majority shareholder of SHS Viveon AG owning a controlling stake and would take the appropriate measures to delist SHS Viveon’s shares from public trading.

Sidetrade is assisted by King & Spalding LLP as legal advisor on the transaction and ODDO BHF SE as financial advisor.

About SHS Viveon AG, a German leader in credit risk & compliance management software applications

Founded in 1991 and headquartered in Munich, Germany, SHS Viveon AG offers applications designed to enable risk, credit, and compliance management teams to automatically identify, assess, and hedge risks in a flexible, digital process. It simplifies access to all relevant data from any system, improves analysis and simulation, and enables better business decisions.

In 2023, SHS Viveon AG reported revenues of €8.8 million. SHS Viveon AG’s customer portfolio currently comprises 80 businesses including Fortune 100 companies.

Olivier Novasque, CEO of Sidetrade commented :

The 2023 fiscal year further confirmed the robustness of Sidetrade’s development model. On the one hand, thanks to our technological lead in AI, 2023 was our most prolific year to date in new Annual Contract Value terms, achieving €11.2 million. Sidetrade delivered remarkable revenue growth, up 20% at constant exchange rates with a 23% increase in SaaS subscription revenues alone for our Order-to-Cash activities. This performance was underpinned by two key growth drivers; our successful US expansion posting revenues up more than 40%, combined with our business strategy targeting multinationals, which triggered a 48% increase in subscription revenues from this segment. Given the SaaS model’s inherent lag between bookings and revenues, the commercial successes of 2023 lead us to confidently anticipate another year of double-digit revenue growth on a full-year basis for the fiscal year 2024.

On the other, 2023 also saw us considerably step up our investments, especially in the United States, as well as relentlessly focusing on Company-wide productivity and efficiency enhancements. To this end, our efforts to streamline processes coupled with a high gross margin (81%) resulted in a significant surge in our operating profit, up 58% to €5.8 million, with an improvement of almost 3 points in our operating margin, which is now at 13% of our revenue versus 10% in 2022. Evidently, the best example of the Company’s successful 2023 performance is its operating cash flow at €8.7 million, a record high over a fiscal year.

Looking beyond these figures, Sidetrade’s model, which is based on a healthy balance between growth and profitability, has once again demonstrated its relevance against a background of economic uncertainty.

Robustness of the profitable growth model confirmed

| Sidetrade (€m) |

2023 | 2022 | Change |

| New Annual Contract Value (ACV) | 11.2 | 10.3 | +9% |

| Revenue | 43.7 | 36.8 | +19% |

| of which ‚Order-to-Cash‘ SaaS subscriptions | 36.6 | 30.1 | +22% |

| Gross margin | 35.3 | 29.0 | +22% |

| as a % of Revenue | 81% | 79% | |

| Operating expenses (OPEX) | (29.4) | (25.3) | +16% |

| Operating profit | 5.8 | 3.7 | +58% |

| as a % of Revenue | 13% | 10% | |

| Net profit | 5.6 | 3.4 | +67% |

2023 consolidated financial statements were audited and will be certified after finalization of procedures required for the annual financial report.

€11.2 million – a new record for bookings in 2023

In 2023, despite economic challenges, Sidetrade proved resilient by exceeding its previous record in New Annual Contract Value (ACV), which totaled €11.2 million, representing an increase of 9%. This performance was driven in particular by the momentum of the US market, with a 22% increase in bookings, accounting for 37% of total bookings.

New SaaS bookings generated €6.18 million, remaining stable despite a slight decline of 4% vs. 2022. Sidetrade focused efforts on the sustainability of its revenues, as reflected in an extension to the initial period for new contracts to 45.5 months in 2023. Total Contract Value (TCV) slightly increased to €21.1 million. Services bookings were up 31%, notably thanks to the growing number of global deployment projects.

Key factors behind this success were Sidetrade’s business strategy targeting companies generating $1 billion-plus revenue, and recognition of its technological edge in artificial intelligence, particularly in the United States. Sidetrade’s comprehensive Order-to-Cash solution results from a strategy of continuous innovation.

Bookings by new customers („New Business“) accounted for 58% of the total new bookings, while the remaining 20% and 22% of bookings were respectively driven by cross-selling and upselling of additional modules to existing customers.

Strong revenue growth, up 20%, with SaaS subscriptions up 23% at constant exchange rates

In 2023, Sidetrade posted brisk growth in its activities, as shown by the 23% increase in its revenue for ‚Order-to-Cash‘ SaaS subscriptions at constant exchange rates, a performance which resulted in growth of 22% on a reported basis. The Company’s revenue for 2023 totaled €43.7 million, as evidenced by the robust increase of 20% at constant exchange rates and 19% on a reported basis.

This favorable trend is largely attributable to three factors:

- Successful expansion in the United States: the North American market continued to propel Sidetrade’s growth, with a substantial increase of 40% in revenues for 2023, reaching €12.1 million. Representing 28% of the Company’s total revenue, North America is now a pivotal pillar for growth.

- Increasing demand from multinational corporations: in 2023, Sidetrade significantly expanded its customer portfolio for ‚Order-to-Cash‘ solutions, delivering growth of 48% in subscriptions with multinational corporations on annual recurring revenue (ARR) contracts in excess of €250,000. Such commitments now account for 43% of Sidetrade’s total subscriptions.

- Contribution from consolidating CreditPoint Software: with H2 2023 revenue of €0.9 million, the CreditPoint Software business had a 2% impact on annual growth.

It should be noted that all multi-year Sidetrade contracts are routinely indexed to inflation (the Syntec for Southern Europe, the UK CPI for Northern Europe and the US CPI for the United States). This measure alters the total price of SaaS subscriptions each year by reference to changes in these price indices, without the need for contract renewals.

CreditPoint Software, an accretive acquisition, now fully operational

On June 30, 2023, Sidetrade bolstered its all-round offering by acquiring the business of CreditPoint Software, an American provider of credit risk management solutions (see press release of July 3, 2023). Consolidated into the Company’s financial statements on July 1, 2023, this business contributed additional revenue of €0.9 million in H2 2023.

All CreditPoint Software employees underwent a fast onboarding process, fostering effective synergies within the Company’s various departments. As a result, the deployment of CreditPoint Software’s solution within the single version of Sidetrade’s platform will be completed by end-H1 2024, delivering all-new and readily available credit risk management functionalities for initial clientele.

The acquisition agreement provided for an initial payment (€0.5 million upon signing) followed by a conditional payment after renewal in October 2023 of CreditPoint Software’s main customer (representing around 50% of its revenues). This customer in the agriculture industry accounted for €0.6 million-plus in annual subscriptions. In early October 2023, Sidetrade not only renewed the contract for the same amount (excluding orders specified above) but also extended the initial contractual period from 36 to 60 months, increasing Total Contract Value (TCV) to €3 million. In doing so, Sidetrade issued an earnout for the acquisition, totaling €2 million. Weeks later, Sidetrade convinced this North American leader to deploy additional Sidetrade solutions in both the US and Australia, resulting in an additional contract of the same worth and length. This new contract positions this customer among Sidetrade’s top five clients, with ARR in excess of €1 million. Note that no subsequent payment was incurred from this second contract since its remit was outside the scope of acquisition. Upon final settlement, the purchase price will total €2.7 million, including the price to acquire services (€0.2 million).

Strong increase in operating margin to 13% with additional investment of €4 million

Marked progress in gross margin, at 81% of revenue, above the SaaS industry average

Gross margin further improved, topping out at 81% of revenue for 2023 (vs. 79% in 2022) and 93% (+1 pt vs. 2022) on SaaS subscriptions alone. In 2023, Sidetrade recorded a year-on-year incremental improvement of €6.3 million in gross margin.

This excellent performance is fueled by the contribution of SaaS subscriptions which now account for 98% of the Company’s total gross margin, a business strategy promoting Sidetrade’s technological edge in AI, and tight cost control despite an inflationary environment. Sidetrade continues to demonstrate the profitability of its SaaS model, which generates significant incremental gross margin, year after year.

Substantial increase in operating margin to 13% of revenue, despite additional investment of €4 million

Operating profit for 2023 totaled €5.8 million, representing an increase of 58% on the 2022 fiscal year (€3.7 million). In 2023, gross margin, with a €6.3 million increase over 2022, amounts to €35.3 million. The significant increase has more than made it possible to support the Company’s investment policy (+€4.0 million vs. 2022), while triggering an all-time surge in Sidetrade’s operating profit.

Operating profit for 2023 includes a French Research Tax Credit of €2.4 million (vs. €2.3 million in 2022) as well as activation of €0.2 million in marginal R&D costs, i.e., 2% of R&D costs for the full year.

As a result, operating margin increased to 13% vs. 10% in 2022, representing a 3-point gain year-on-year.

Net profit up 67% to €5.6 million vs. €3.4 million in 2022

Net financial income for 2023 stood at €0.4 million, up significantly from 2022, mostly due to interest earned on short-term investments during the year.

Corporate income tax for 2023 was estimated at €0.6 million, vs. €0.4 million in 2022.

All told, Sidetrade’s net profit for 2023 was €5.6 million, up 67%, demonstrating that a balance between growth and profitability is achievable

Strengthened financial position

The fiscal year 2023 enabled the Company to considerably increase its operating cash flow to €8.7 million (vs. €4.0 million in 2022), representing a record high over a fiscal year.

Sidetrade reported €23.9 million in gross cash at year-end, representing an increase of €3.6 million vs. 2022. As of December 31, 2023, Sidetrade also held 86,697 of its own shares with a value of €14.0 million.

With a financial debt of €10.3 million (reduced by €1.7 million), Sidetrade increased its investment capacity to accelerate its expansion.

Distinguished CSR commitment: rated Gold by EthiFinance and Silver by EcoVadis

In 2023, Sidetrade’s commitment to Corporate Social Responsibility (CSR) was formally outlined with the publication of its first-ever CSR report. To that end, the Company focused its efforts on four priorities:

- Sustainability, by implementing initiatives aimed at reducing its carbon footprint;

- Collaborative excellence, by championing diversity and innovation within its teams;

- Data security, by safeguarding the protection of data;

- Ethical business practices, by building relationships founded on transparency and integrity.

Much like its initial assessment, Sidetrade’s carbon assessment for 2023 (scopes 1, 2 and 3) is the result of a rigorous application of the Bilan Carbone® methodology and covers all its worldwide operations. It heralds a new stage in the process to cut greenhouse gas emissions, strengthening Sidetrade’s position as a responsible leader in the technology sector.

Both EthiFinance and EcoVadis have recognized the accomplishments of Sidetrade’s CSR strategy. First, EthiFinance awarded the Company a Gold medal and a score of 76/100. Second, Sidetrade secured a Silver medal with EcoVadis with an overall score of 68/100. The latter places Sidetrade in the top 25% of companies in sectors across the board. These awards underscore the effectiveness of the Company’s CSR strategy, reflecting its commitment as a corporate citizen that is ready to face the challenges of today and tomorrow.

Continued growth in 2024, on the back of an unprecedented 2023

Over the past few quarters, Sidetrade has consolidated its leadership with ambitions to become the world leader in the fast-growing and rapidly globalizing Order-to-Cash market.

Sidetrade looks ahead to the fiscal year 2024 with confidence, driven by an ambitious vision, and has the resources to fulfill its targets. For 2024, Sidetrade confirms revenue growth in the double digits. This positive momentum illustrates the Company’s ongoing commitment to innovate and deliver increasingly impactful solutions, in turn, achieving sustainable growth for employees, customers and partners alike.