On July 7, 2025, in a moment filled with pride and emotion, Sidetrade’s Founder and CEO, Olivier Novasque, visited the Euronext Paris headquarters alongside some of the company’s historic figures to mark two decades of public listing. The traditional market opening bell ceremony highlighted two decades of uninterrupted

growth and bold entrepreneurship that have established Sidetrade as a world leader in the Order-to-Cash space. Twenty years after its IPO, Sidetrade stands as a unique French tech success story, built on a foundation of performance, innovation, resilience, and independence.

Olivier Novasque (Founder & CEO, Sidetrade)

surrounded by core team members and historic contributors.

A founding vision: leveraging technology to power business cash flow

When Olivier Novasque founded Sidetrade in 2000, his goal was to build a valuable, agile company ahead of its time. He foresaw the need to reinvent the financial relationship between customers and suppliers, moving away from a purely administrative model toward one driven by performance. Based on this vision, he laid the foundation for a technology platform designed to deeply transform cash flow generation. Going against the prevailing standards of the time, he rejected the dominant on-premises model and bet on SaaS from the very beginning, an audacious move that proved visionary.

A former finance executive turned entrepreneur, Novasque made the rare choice to raise only essential funds. Instead, he prioritized self-financed growth, aiming to build a high-quality, industrial-grade, tech-driven business.

I believe the best companies aren’t necessarily those that raise the most money, but those that work tirelessly to execute their vision with rigor, creativity, and resilience, said Olivier Novasque, CEO and founder at Sidetrade. Today, I want to honor everyone, past and present, who has contributed to Sidetrade’s journey. I’m proud to be surrounded by an executive team united by a spirit of ambition, innovation, and excellence. Together, with all Sidetraders, we are ushering Order-to-Cash into the age of the Agentic Revolution.

For years, tech company success was often measured by the size of their fundraising rounds rather than their ability to sustain a viable business model. Sidetrade took a different route, rooting its growth in self-financing. Aside from €2 million raised pre-IPO and a €4.5 million capital increase at IPO, Sidetrade has never resorted to public fundraising or shareholder dilution.

As of today, the company holds nearly €50 million in cash and treasury shares. This performance is the result of a sustained growth strategy and over a decade of investment in artificial intelligence, funded entirely by the company’s ability to generate cash year after year. In 2024, the company delivered a standout performance:

- Revenue growth of +26% (+16% on a comparable basis)

- Operating margin of 15%

- Net income of €7.9million

- Free cash flow of €8.7million

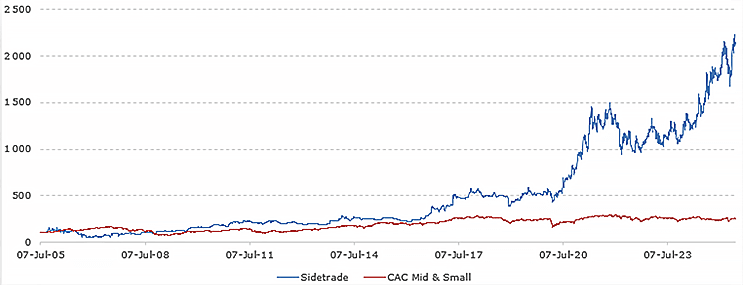

This financial discipline has in no way compromised shareholder value creation. Listed at €12.50 in 2005, Sidetrade’s share price has increased twentyfold, reaching €249 as of July 4, 2025. This represents a stock market performance of over +1,800%, more than 11 times that of the CAC Mid & Small index, which rose by +164% over the same period.

Sidetrade’s share price growth, indexed to 100 since IPO (July 7, 2005)

A recognized technology leader

Innovation is part of Sidetrade’s DNA. In 2025, the company’s innovation capabilities were recognized by some of the most respected rankings in the sector:

- Named a Leader in Gartner® Magic Quadrant™ for the third consecutive year

- Identified by IDC as a key player in financial automation

- Ranked among Europe’s 150 Most Innovative Companies by Fortune

These accolades highlight the uniqueness of Sidetrade’s technology foundation, which includes a cloud-native architecture, proprietary action-oriented AI, and a one-of-a-kind payment behavior Data Lake, enriched with over $7.2 trillion in intercompany transactions.

From its humble beginnings in a Paris office to a global presence, Sidetrade has followed a trajectory of organic growth reinforced by nine acquisitions. The company has rigorously executed its model while expanding geographically across Germany, the UK, Ireland, the US, Canada, and of course, France. Today, with 65% of revenue generated outside France, Sidetrade supports major enterprises in 85 countries as a partner in their financial transformation.

Sidetrade’s inclusion in the Euronext Tech Leaders index in June 2025 marks more than institutional recognition; it affirms the rise of a European tech champion capable of combining breakthrough innovation with profitable growth to power the next generation of enterprise finance.

Congratulations to Sidetrade on 20 years of public listing on Euronext, said Delphine d’Amarzit, Euronext Paris Chairwoman and CEO. Sidetrade’s remarkable stock market journey is a testament to its sustained growth and demonstrates the power of Euronext to help local SMEs become global mid-cap players while preserving their independence. It perfectly embodies the synergy between entrepreneurial ambition and the excellence of European capital markets, recently underscored by Sidetrade’s entry into the Euronext Tech Leaders index.

Sidetrade’s unique trajectory, combining technological innovation, financial performance, and capital discipline, is now catching the attention of American institutional investors. Sidetrade’s stock performance reflects a remarkable growth journey and a robust business model built on high revenue recurrence, operational excellence, and cash generation, said Jean-Pierre Tabart, Senior Analyst at TP ICAP Midcap. Above all, we believe the group still holds significant upside potential. Beyond the strength and durability of its fundamentals, a substantial valuation gap remains compared to North American SaaS players. Moreover, the current share price does not reflect the stock’s strategic value, driven by its scarcity—there are very few opportunities in the European market to gain exposure to a true SaaS company—and by Sidetrade’s lead in artificial intelligence, which is expected to further reinforce its technological leadership in the Order-to-Cash space.

Sidetrade is one of the few long-term success stories on the Euronext stock market. With a robust and exportable model, the company has established itself as a global leader with solutions deployed across multinational companies. This trajectory, built with discipline and vision, is now entering a new chapter: one of AI-augmented finance, where more intelligent, more autonomous, and entirely focused on the AI agent revolution.

The Europe’s Most Innovative Companies 2025 list, compiled by Fortune in partnership with Statista, is based on more than 108,000 evaluations by experts and employees, enriched by the LexisNexis® patent portfolio index. Each company is assessed across three dimensions: product innovation, process innovation, and innovation culture. Sidetrade stood out for the strength of its innovative mindset, a key driver in its ability to reshape financial practices across the Order-to-Cash field.

This recognition crowns a continuous innovation trajectory that began with the company’s founding in 2000. This momentum originated in Paris, France, where the company built its technological foundation within an ecosystem that has since achieved global recognition. As of 2025, the French capital’s technology ecosystem ranks fourth globally, according to Dealroom, surpassing London, Munich, and Stockholm.

Since its inception 25 years ago, Sidetrade has been at the forefront of technological disruption, said Olivier Novasque, Founder and CEO of Sidetrade. This recognition by Fortune comes at a pivotal moment, as we enter the era of agentic AI. For our clients, this marks the era of augmented finance, with virtually unlimited capabilities that can absorb business complexity. For us, it reflects a technological lead we estimate to be over three years ahead of our market.

By equipping finance departments with autonomous agents capable of acting, communicating, and adapting in real time, Sidetrade is redefining the foundations of the Order-to-Cash process. This shift from assistive AI to executional AI represents a strategic inflection point, described by several analysts as a business model transformation.

The emergence of agentic AI marks a turning point in the operating model of corporate finance, noted Jean-Pierre Tabart, Analyst at TP ICAP. With its technological lead, mastery of real-time behavioral data, and ability to industrialize autonomous intelligence at scale for large enterprises, Sidetrade stands out as a strategically undervalued asset, poised to capture increasing value in an under-equipped market.

Launched by Euronext in 2022, the Tech Leaders brings together the 110 most dynamic listed European tech companies, providing them with enhanced visibility, targeted investor access, and exclusive participation in pan-European innovation forums. Sidetrade’s inclusion reflects its alignment with the criteria of the index:

- A track record of building technologies with transformative impact,

- A market cap above €300 million?

- A CAGR (Compound Annual Growth Rate) above 20% over the last three years.

The Euronext Tech Leaders Index will be updated after markets close on Friday, 20 June 2025, with effect from Monday, 23 June 2025.

Delphine d’Amarzit, Euronext Paris Chairwoman and CEO, states: Sidetrade’s 20th anniversary of being listed coincides with the highest possible recognition of its stock market journey: its inclusion in the Euronext Tech Leaders, which brings together technology companies listed on Euronext that stand out for their growth and innovation. I am pleased that the stock exchange has fully played its role in supporting the growth of a company like Sidetrade, which now ranks among the most promising tech companies in Europe, thanks to the long-term vision of its founder, Olivier Novasque, and the work of its teams.

Sidetrade’s trajectory reflects a conviction that the future of enterprise finance lies in autonomous systems capable of acting intelligently in dynamic environments. Innovation is in the DNA of Sidetrade. From the outset, the company has approached AI not as a layer of enhancement, but as the engine driving systemic change.

Central to this transformation is Aimie, Sidetrade’s agentic AI. Built to go beyond predictive analytics, Aimie is an autonomous agent that makes decisions, initiates actions, and adapts in real-time to optimize cash flow processes. From qualifying invoices to orchestrating engagement strategies and accelerating cash collections, Aimie scales behavior-based decision-making across a global network of over 40 million buyers. This intelligence is grounded in Sidetrade’s Data Lake, the world’s richest behavioral dataset for B2B transactions, encompassing more than $7.2 trillion in payment data. It is this combination of machine learning, behavioral modeling, and collaborative intelligence that positions Aimie as an operator that learns, acts, and evolves in the service of enterprise performance.

The inclusion in the Euronext Tech Leaders segment is also a tribute to Olivier Novasque’s vision as founder and CEO of Sidetrade. Marking 25 years of innovation at Sidetrade, Novasque has championed a bold roadmap to move finance beyond automation and into real-time intelligent orchestration, transforming the CFO office from a reactive unit to a proactive command center.

We are honored to join the Euronext Tech Leaders, said Olivier Novasque, CEO and founder at Sidetrade. At Sidetrade, we’ve never followed the market. We’ve questioned its limits and investigated how technology should overcome them. In a financial world that is growing increasingly complex by the day, we believe the real breakthrough lies in augmenting human capacity. Our technology is designed to sharpen judgment, accelerate action, and foster resilience. When machines enhance talents, organizations unlock their full potential.

Powered by Sidetrade’s Data Lake, the new Aimie orchestrates Order-to-Cash (O2C) processes, executing phone calls, interacting with debtor clients, escalating and flagging issues or exceptions for human follow-up actions where necessary. Announced at the Gartner CFO & Finance Executive Conference today, this launch marks a decisive leap beyond automation.

Ushering in a new era for CFOs, Global Business Services, and Shared Services

In the current economic climate, traditional financial systems, rule-based automation, large teams handling low-value calls, and follow-up email campaigns have all revealed their limitations. The race for competitiveness is not just won with automation. It is also won with speed, precision, and the ability to make sense of vast and fragmented data. Chief Financial Officers (CFOs), Global Business Services, and Shared Services leaders must accelerate cash flow generation, less operational overheads, and scale faster.

Aimie is now agentic. Designed as an enterprise teammate, her first capability is being an autonomous Cash Collection Agent, trained on $7.2 trillion in payment experiences and insights from 40 million buyers worldwide. Simply put, Aimie does not wait for instructions, said Rob Harvey, Chief Product Officer at Sidetrade. Aimie does much more than merely follow a script; she makes decisions. That’s the real breakthrough. Agentic AI propels Order-to-Cash processes beyond automation into autonomous decision-making, unlocking new levers for sustainable financial performance. By combining human oversight with self-directed agents, we are creating an opening for more adaptive, scalable finance operations, where manual processes do not hold back growth.

Aimie’s Cash Collection Agent is ready for deployment across Europe and North America:

- Autonomous outbound calling (first contact calls, follow-up calls, voicemail messages) with personalized dialogues suited to every situation;

- Outcome qualification with automatic case updates;

- Escalation when a material risk is detected.

Unlike static bots, Aimie continuously learns from live outcomes, adjusts outreach strategies, and refines prioritization using predictive signals from Sidetrade’s Data Lake.

Championing consistency to elevate performance

Early adopters are already experiencing real-world impact. What I love most about Aimie isn’t the cost savings; it’s her consistency, said Stephen Dyer, VP Credit & Collections at OpenText. I manage 100+ collectors globally, and inconsistency is inevitable. Aimie guaranteed precise, repeatable execution which is a game-changer! She also helps to reshape the modern customer 360, enabling us to move past traditional customer experiences toward a data-driven, personalized relationship that can be replicated at scale.

Aimie empowers Sidetrade customers with distinctive capabilities:

- Rapidly learning a company’s culture, products, and terminology, adapting communication in a way that feels native to their brand.

- Engaging in interactive, qualified conversations with thousands of buyers at scale, acting as a fully-fledged game-changer for managing massive SMB account portfolios, at low cost.

- Speaking up to 29 languages: allowing for seamless cash collection in local languages and contexts.

- Making 1,000 outbound calls daily, operating 24/5.

- Accelerating cash flow by scaling the most effective channel in collections: outbound calling.

Aimie takes on the high-volume, low-value tasks that drain finance teams, automating repetitive work with consistency, wherever the geography. The results? Reduced administrative burden on accounts receivable, so talent can refocus on strategic impact. Speaking with early adopters, Harvey commented: They are not worried about a robot taking their job… because most of them already feel like they are doing the robot’s job. Moreover, they are aware that if we fail to design an AI co-worker, tomorrow’s finance will feel less human as they will be stuck talking to accounts payable robots instead of solving real strategic problems.

Building on CFOs economic environment

Aimie’s unique advantage is Sidetrade’s Data Lake, which manages 10 payment events per second across one billion transactions, making it the largest real-time O2C behavioral database in the market. Aimie’s intelligence comes from context-rich data, not just clever LLM’s, said Mark Sheldon, Sidetrade’s Chief Technology Officer. Generic AI systems lack the contextual data needed to operate as domain experts. But Aimie does. With $7.2 trillion in behavioral payment signals, Aimie adapts with pinpoint precision, and she keeps learning. Finance departments gain access to a new resource: tireless and infinitely scalable.

Sidetrade has been training finance-specific models since 2015, with generative capabilities added in 2024. The AI Cash Collection Agent is part of a broader rollout of Sidetrade’s new agentic AI, which includes purpose-built agentic functionalities for email auto-response, portal data extraction, and cash application exception handling. As an AI orchestrator, Aimie coordinates a team of domain-specific agents to run the O2C cycle autonomously. AI goes agentic, stated Harvey. Each agent operates independently to process thousands of customer emails and payments per day. Together, they represent a step-change in how finance teams execute their O2C processes.

Sheldon concluded: Short-term, what companies need to define is the level of autonomy they are willing to delegate to agents, the role human oversight should play, and how best to optimize their resources in this new paradigm. Rather than giving in to fears around agentic AI or human replaceability, I encourage business leaders to rethink the role of people within organizations that fully harness this technological shift. The most forward-thinking leaders already augment operational efficiency while repositioning their teams toward higher-value, strategic work.

Aimie, Sidetrade’s AI Cash Collection Agent, is now available for early adopters.

Meet Aimie, here.

Sidetrade’s 2024 Annual Report provides an in-depth analysis of the company’s ecosystem, strategic direction, and governance framework. It also reviews the key milestones that shaped the past financial year. Beyond the financial results, the report connects economic performance and non-financial impact, demonstrating Sidetrade’s commitment to responsible growth, exemplary governance, and sustainable value creation.

This report is designed for investors, partners, customers, and stakeholders who want a deeper understanding of how Sidetrade anticipates, innovates, and shapes the future of corporate finance. It is available on the company’s website here.

Philippe Gangneux, CSR Ambassador and Chief Financial Officer of Sidetrade, commented:

In 2024, we delivered record revenue and profitability, while expanding our AI innovation and international footprint. For the second year, we’re integrating both financial and non-financial performance to give our stakeholders a transparent, 360° view of how Sidetrade creates value. Our ability to combine sustained growth, operational excellence, and long-term impact is what sets us apart.

This year’s Annual Report goes beyond numbers, highlighting how our intelligent solutions, powered by the Sidetrade Data Lake, are not only accelerating cash flow performance for our customers, but helping finance leaders rethink what’s possible in the age of generative AI.

Olivier Novasque, CEO of Sidetrade commented:

While the start of the year has been shaped by an uncertain economic climate—particularly in the United States—we continue to deliver double-digit revenue growth quarter after quarter. In Q1, we commend the strong performance of our European bookings, reflecting solid commercial momentum among existing clients. This was driven by the adoption of new product modules and geographic expansion into new countries. This expansion within our installed base effectively offset the more cautious stance of decision-makers in the US market. Achieving a near-perfect balance (50/50) in our development model over the past three years—between bookings from Europe versus the United States on one hand, and new customer sales versus existing customer upsell on the other—has equipped us with the resilience to navigate more turbulent periods when one of these components temporarily falters. Looking ahead across all four quarters of fiscal year 2025, we are confident in our ability to maintain this equilibrium. Regarding Q1 revenue, our record bookings in 2024, combined with a revenue recurrence rate exceeding 90% and the contribution from SHS Viveon, has enabled us to achieve a strong growth of +22%, continuing the momentum from our standout 2024 performance.

€2.77 million in Annual Contract Value (ACV) in Q1 2025

In the first quarter of 2025, Sidetrade delivered a solid performance, recording €2.77 million in Annual Contract Value (ACV) from new signed contracts, compared to €3.98 million in Q1 2024. It is important to note that Q1 2024 represented an exceptionally high comparison base, with triple-digit growth of +117%, nearing the Company’s all-time record of €4.1 million. While Q1 2025 marks a year-over-year decline of 30% against this particularly strong prior-year quarter, the performance remains robust in absolute terms and significantly exceeds the €1.83 million recorded in Q1 2023, representing a +51% increase over that period.

During the quarter, strong performance in Europe—driven by existing customers and accounting for nearly 90% of total bookings—more than offset a more mixed performance in the United States. This European momentum was supported by the successful commercialization of new product modules, including CashApps and Augmented Invoice, the latter being dedicated to electronic invoicing. In North America, bookings contributed 15% of Q1 2025 total bookings. The region faced a more cautious investment environment, as key decision-makers adopted a wait-and-see approach regarding new project commitments.

In addition, new SaaS bookings (New ARR) totaled €1.28 million, compared to €1.85 million in Q1 2024, while Services bookings totaled €1.49 million versus €2.13 million in Q1 2024.

Sidetrade’s development model—balanced between North America and Europe, and between new customer acquisitions and upsells to the existing client base—provides the Company with strong resilience against short-term market imbalances. This quarter, solid expansion sales in Europe among existing customers ultimately enabled the Company to deliver a robust overall performance, despite a more challenging macroeconomic environment in the US.

Solid revenue growth of +22%, driven by a +26% increase in SaaS subscriptions, reflecting strong recurring revenue momentum

| Sidetrade (€m) |

Q1 2025 | Q1 2024 | Change |

| SaaS subscriptions | 12.1(1) | 9.6 | +26% |

| revenue | 14.3(2) | 11.8 | +22% |

All the 2025 information of this financial release is from consolidated, unaudited data.

(1) includes €1.35 million in recurring revenue from SHS Viveon

(2) includes €1.90 million in total revenue from SHS Viveon

Sidetrade recorded a very strong start to fiscal year 2025, posting revenue of €14.3 million for the first quarter, representing year-over-year growth of +22%.

SaaS subscriptions reached €12.1 million in Q1 2025, reflecting year-over-year growth of 26%, including +12% on a like-for-like basis (excluding the integration of SHS Viveon). This sustained pace underscores the effectiveness of Sidetrade’s SaaS business model and its ability to efficiently convert bookings into recognized revenue.

In the first quarter of 2025, Services revenue posted modest growth of +3%, reaching €2.2 million. On a like-for-like basis (excluding the impact of SHS Viveon), this represents a decline of -20%. This trend reflects a lower volume of new large-scale projects and more limited-service engagements related to SaaS subscriptions among existing clients.

Sidetrade continued to expand its footprint with large multinationals. In Q1 2025, subscriptions from companies generating over €2.5 billion in annual revenue grew by 44%. For the first time, contracts from these large enterprises accounted for more than half of Sidetrade’s total subscription revenue, representing 53% of the total—underscoring the Company’s increasingly strong positioning within the large enterprise segment. This momentum is expected to remain a key growth driver in the coming quarters.

The integration of SHS Viveon’s operations (effective as of July 1, 2024) contributed €1.9 million to Sidetrade’s revenue in the first quarter of 2025, accounting for 13% of the total quarterly revenue.

It is important to note that all of Sidetrade’s multi-year contracts are systematically indexed to inflation—using the Syntec index for Southern Europe, the UK Consumer Price Index (CPI) for Northern Europe, and the U.S. CPI for the United States. This mechanism ensures that annual price adjustments are applied automatically to SaaS subscription fees in line with inflation trends, without the need to wait for contract renewal.

| Sidetrade (€m) |

2024 | 2023 | Change |

| Revenue | 55.0(1) | 43.7 | +26% |

| SaaS subscriptions | 45.5(2) | 36.6 | +22% |

| Gross margin | 43.1 | 35.3 | +22% |

| Operating expenses (OPEX) | (34.6) | (29.4) | +18% |

| Operating margin (3) | 8.4 | 5.8 | +45% |

| as % of revenue | 15% | 13% | |

| Net profit | 7.9 | 5.6 | +40% |

2024 information is from consolidated, unaudited data.

(1) includes €4.4m in SHS Viveon revenue

(2) includes €3.0m in SHS Viveon recurring revenue

(3) Operating margin corresponds to operating profit based on 2024 accounting standards in France, including the French Research Tax Credit.

Olivier Novasque, CEO of Sidetrade commented:

2024 once again illustrates the strength of Sidetrade’s business model, combining growth with profitability. Our 26% revenue increase was driven by a major breakthrough in the North American market, a leading-edge AI offering embraced by large enterprises, and the acquisition of SHS Viveon in Germany, which has further solidified our leadership in Order-to-Cash solutions across Europe. For the first time in our history, we have surpassed €8 million in operating profit, a significant 45% increase, highlighting the effectiveness and balance of our expansion strategy. But the real story goes beyond this impressive performance. We are witnessing an accelerated revolution in how businesses leverage artificial intelligence, marked by the emergence of specialized AI agents. Unlike traditional automation models that rely on rigid rule-based programming and constant human oversight, AI agents bring a new level of autonomous decision-making and real time operational optimization. These are no longer mere automation tools; they are intelligent entities capable of anticipating needs and acting independently within a company’s IT infrastructure, with minimal human intervention. Where traditional software simply organizes workflows using pre-defined rules, an AI agent trains, learns, adapts, and executes complex processes on its own. And this agentic revolution is only just beginning! At Sidetrade, Aimie represents the next generation of AI, evolving into an agentic AI that will orchestrate a network of AI agents, each managing a specific link in the Order-to-Cash cycle: risk, disputes, collections, cash application, and more. Aimie will direct, coordinate, and interconnect these high-specialized agents. Backed by the Sidetrade Data Lake, the most unique in the Order-to-Cash market and built on $7.2 trillion in B2B transactions spanning over 39.9 million businesses, Aimie is already powered by a one-of-a-kind training dataset in our field that will give its AI agents unmatched intelligence. Thanks to intensified R&D investments in 2024, we are set to launch our first next-gen AI agent in 2025, one that will redefine the boundaries of autonomy and capability. Companies that fail to embrace this paradigm shift will be rapidly outpaced by those that embed AI agents at the core of their operational excellence. With Aimie, Sidetrade is fully aligned with this AI agent revolution and is uniquely positioned to lead the race in its field.

New record in year-over-year bookings (+13% in ACV)

Sidetrade maintained its growth trajectory in 2024 and set a new record with Annual Contract Value (ACV) reaching €12.73 million, up 13% compared to 2023. Annual Recurring Revenue (New ARR), increased by 6%, amounting to €6.53 million while Services bookings grew by 21%, totaling €6.2 million.

Bookings by new customers (“New Business”) accounted for 63% of total new bookings in 2024, while contract extensions (“Cross-sell”) and additional modules to existing customers (“Upsell”) contributed 18% and 19% of bookings, respectively.

Strong revenue growth in 2024: up 26% with SaaS subscriptions up 22%

In 2024, Sidetrade reported annual revenue of €55.0 million, marking a 26% increase compared to the previous year, and a 16% increase on a reported basis (excluding the acquisition of SHS Viveon finalized in June 2024). Several factors contributed to this strong performance:

- Sustained organic growth: Overall revenue (excluding the acquisition of SHS Viveon) grew by 16%, while SaaS subscriptions increased by 15%. Meanwhile, Services showed impressive growth of 24%, driven by global implementation projects.

- Strategic acquisition of SHS Viveon opening the DACH region: Since July 1, 2024, SHS Viveon has contributed €4.4 million to Sidetrade’s revenue, now accounting for 15% of total revenue in the second half of 2024.

- Expanding international reach: The integration of SHS Viveon has increased the share of revenue generated outside of France to 65%. With 70% of its workforce now based internationally, Sidetrade demonstrates its ability to scale globally while maintaining strong local client relationships, key to building trust and driving operational efficiency.

- Outstanding performance in North America: North America recorded the highest growth in 2024, with a 36% increase, bringing annual revenue to €16.6 This strategic market is central to Sidetrade’s ambitions.

Sidetrade continues to strengthen its position among multinationals, with a 44% increase in subscriptions from companies generating over €2.5 billion in revenue. These contracts now represent 50% of total subscriptions. More broadly, companies generating over €1 billion in revenue account for 79% of the portfolio, cementing Sidetrade’s status as a preferred partner for large enterprises.

Gross margin and operating margin: strongly accelerating performance

Strong growth in gross margin: +22% with an increase of €7.8million

The sustained momentum in subscription growth continued to drive the expansion of the gross margin in 2024. On a like-for-like basis (excluding SHS Viveon), the gross margin rate for subscriptions remained particularly high at 92%, compared to 93% in 2023. SaaS subscriptions now represent 97% of the total gross margin.

Sidetrade’s overall gross margin rate on a like-for-like basis stood at 80%, versus 81% the previous year. Including the impact of SHS Viveon acquisition, the consolidated gross margin rate reached 78% of total revenue for the 2024 fiscal year.

In total, in 2024, Sidetrade delivered an incremental gross margin increase of €7.8 million compared to 2023, representing a +22% year-over-year growth.

Operating margin exceeding 15% of revenue (vs 13% in 2023)

Sidetrade’s operating margin showed a remarkable increase, reaching €8.4 million in 2024, up 45% from €5.8 million in 2023. This profitability is driven by sustained business growth, an excellent gross margin and disciplined cost management.

Thanks to this momentum, Sidetrade has continued its investment strategy, with an increase in expenditure of €5.2 million over 2023, and a particular focus on R&D (+€2.4 million), notably to accelerate the integration of generative AI into its core product offering.

The 2024 operating margin includes a French Research Tax Credit of €2.6 million (versus €2.4 million in 2023) as well as activation of €0.16 million in marginal R&D costs, i.e., 2% of R&D costs for the full year.

As a result, Sidetrade’s operating margin stands at 15% of revenue versus 13% in 2023, representing a 2-point gain year-over-year.

Surge in net profit to €7.9 million: up 40%

Sidetrade’s financial income, recorded as of December 31, 2024, stands at €0.7 million, up significantly from 2023 (€0.4 million). This performance is mostly due to interest earned on short-term investments during the year and the foreign exchange gains realized over the period.

Corporate income tax for 2024 is estimated at €1.1 million, versus €0.6 million in 2023.

All told, Sidetrade’s net profit for 2024 was €7.9 million, an increase of 40%, confirming the solid balance between growth and profitability.

Operating cash flow strongly supporting the acquisition of SHS Viveon

In 2024, Sidetrade generated a solid operating cash flow of €9.6 million, up €3.3 million (excluding the timing impact of the French Research Tax Credit refund). This level of cash generation enabled the Company to fully self-finance the acquisition of SHS Viveon, with a net cash outlay of €5.2 million (€6.6 million for the purchase of shares, offset by €1.4 million in available cash held by SHS Viveon).

As of December 31, 2024, Sidetrade reported €25.2 million in gross cash, up €1.3 million compared to year-end 2023.

In addition, Sidetrade held 85,437 of its own shares, valued at €19.1 million as of December 31, 2024.

Financial debt stood at €7.9 million, down €2.3 million year-over-year. Even after the SHS Viveon acquisition, Sidetrade retains substantial investment capacity, well-positioned to support its continued expansion strategy.

Recognized ESG commitment: Platinum by EthiFinance and Silver by EcoVadis

In 2024, Sidetrade accelerated its transition toward becoming a more responsible company and was awarded a Platinum medal from EthiFinance and a Silver medal from EcoVadis, with respective scores of 84/100 and 70/100. Now ranked among the top 15% of the most highly rated companies audited by EcoVadis, demonstrating its leadership in social responsibility.

These accolades confirm the relevance of Sidetrade’s strategy and its ability to anticipate the environmental and social challenges of tomorrow.

Sidetrade looks ahead to the fiscal year 2025 with confidence and a clear vision, and has the resources to fulfill its ambitions.

For the year 2024, Sidetrade achieved an overall rating of 84/100 from EthiFinance, the rating agency specializing in European-listed SMEs. This score places Sidetrade at the highest level with a Platinum medal with an 8-point increase from 2023. The improvement reflects tangible progress in reducing environmental impact, strengthening governance and ethical frameworks, and embedding sustainability into corporate strategy.

Sidetrade also enhanced its standing with EcoVadis, the world’s most trusted business sustainability ratings, with a 70/100 score for 2024 and earning a Silver medal for the second consecutive year. A key highlight was Sidetrade’s significant improvement in environmental performance with a 10-point jump in this category. This advancement reflects the company’s targeted sustainability initiatives and responsible business practices. As a result, Sidetrade ranks among the top 15% of the highest-performing companies across all industries, audited by EcoVadis.

Philippe Gangneux, CFO and CSR Ambassador at Sidetrade commented: Since 2021, we have been implementing an ambitious ESG roadmap. Sidetrade’s steady rise in ESG rankings reflects a dynamic approach where economic performance and positive impact go hand in hand. Today, the results are significant, and our impact is recognized by EthiFinance and EcoVadis. These distinctions strengthen our determination to redefine standards, drive relentless innovation, and embed sustainability at the core of our business model

A long-term commitment to sustainability

Sidetrade’s CSR strategy is structured around four pillars:

- Reducing Carbon Footprint: Implementing initiatives to minimize its environmental impact and align its actions with the Paris Agreement targets.

- Fostering Innovation and Inclusion: Promoting talent diversity and collaborative excellence to drive creativity and ensure equal opportunities.

- Digital Security and Ethics: Strengthening data protection standards and advocating for responsible digital practices.

- Integrity and Transparency: Upholding ethical business practices and exemplary governance.

By the end of the year, Sidetrade will publish its Bilan Carbone® and 2024 CSR Report. Learn more about Sidetrade’s CSR commitments.

Interpath is a fast-growing firm that supports clients with advisory and restructuring services and has operations in the UK, France, Ireland, Germany, Austria, Bermuda, Cayman Islands, BVI, and Algeria. The alliance with Sidetrade will support the firm’s continued growth and further enhance its ability to create, defend, preserve, sustain and grow value for its clients through working capital optimization. In turn, Sidetrade will be able to draw on Interpath’s advisory capabilities across a wide range of markets and channels to help more leadership teams transform their Order-to-Cash operations.

Kevin Schafer, AVP Partners Europe, at Sidetrade, commented: We are excited to join forces with Interpath to extend the reach of Aimie, Sidetrade’s AI assistant, to a wider spectrum of organizations. By combining Interpath’s industry expertise with our advanced technology, we are creating a powerful synergy to help businesses unlocking new efficiencies in optimizing working capital and driving sustainable cash flow growth.

The new alliance is set to reshape the way businesses tackle working capital challenges. It aims to empower organizations with digitally transformative solutions, delivering tangible results in an increasingly dynamic financial environment.

Sidetrade has consistently been recognized as a leader in the global Order-to-Cash the market, thanks to its powerful AI technology powered by the Sidetrade Data Lake which processes $6.1 trillion in B2B payment transactions real-time daily in Sidetrade’s cloud to provide users with a unique market view. Sidetrade has been positioned as a Gartner® Magic Quadrant™ Leader since 2022. It was also named a Leader in the IDC MarketScape: Worldwide Accounts Receivable Automation Applications for the Enterprise 2024 Vendor Assessment (doc #US51740924, December 2024).

Hope Rosenbaum, Chief Growth Officer, Head of Alliances at Interpath, commented: Sidetrade offers a world-class Order-to-Cash solution that leverages AI and cloud technology to make a transformational impact, complementing the work we do every day to help clients improve their financial performance and create value. The alliance couldn’t be timelier as businesses look for ways to make their cashflow work for them and find a more sustainable financial future. We look forward to working with Sidetrade as we leverage the technology and harness the expertise that we both hold to make a real difference for businesses we support across our international networks.

Gartner, Magic Quadrant for Invoice-to-Cash Applications, 6 May 2024, Tamara Shipley Et Al.

Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

Briarwood Chase Management, a prominent US-based investment firm, has surpassed the 5% ownership threshold in Sidetrade (Euronext Growth: ALBFR.PA). The decision to build its shareholding follows a comprehensive analysis of the SaaS leader’s economic model and a meeting at Sidetrade’s headquarters, solidifying the firm’s confidence in the CEO’s visionary leadership, its AI roadmap and market potential.

Robert Blatt, Managing Director of Briarwood Chase Management, said: Our position in Sidetrade underscores our commitment to investing in exceptional businesses and management teams. Sidetrade’s strategic focus on and growth in North America, and exceptional margin potential align with our investment philosophy. In today’s economic environment, Sidetrade distinguishes itself as a robust and high-quality SaaS player, offering built-in growth, strong revenue predictability and recurring income. Furthermore, its status as a sought-after contender in a consolidating market highlights its significant medium-term potential. We are looking forward to being long-term partners to the business and management team.

Sidetrade, recognized as a leader by top US technology research and consulting firms, is transforming the Order-to-Cash industry by simplifying the daily operations of financial leaders in large organizations to deliver immediate productivity improvements while securing and accelerating cash flow generation. This innovative approach sets new standards and redefines what’s possible in accounts receivable.

We are very excited to have the trust of Briarwood Chase Management in our growth journey, Olivier Novasque, CEO of Sidetrade, commented.After two years of rapid expansion to build a critical foothold in the US, 2024 was a year of strategic consolidation, focusing on strengthening our foundations and fine-tuning our teams. With the US market showing exceptional momentum, we are reigniting investments in 2025 to seize this unparalleled opportunity and drive Sidetrade’s growth to the next level.

The rapid rise of generative AI and the growing demand for efficiency are leading businesses to adopt cutting-edge technologies like Sidetrade’s. At the heart of Sidetrade’s innovation is Aimie, the most unique AI which – powered by the Sidetrade Data Lake – drives smart customer insights and delivers value for businesses worldwide.